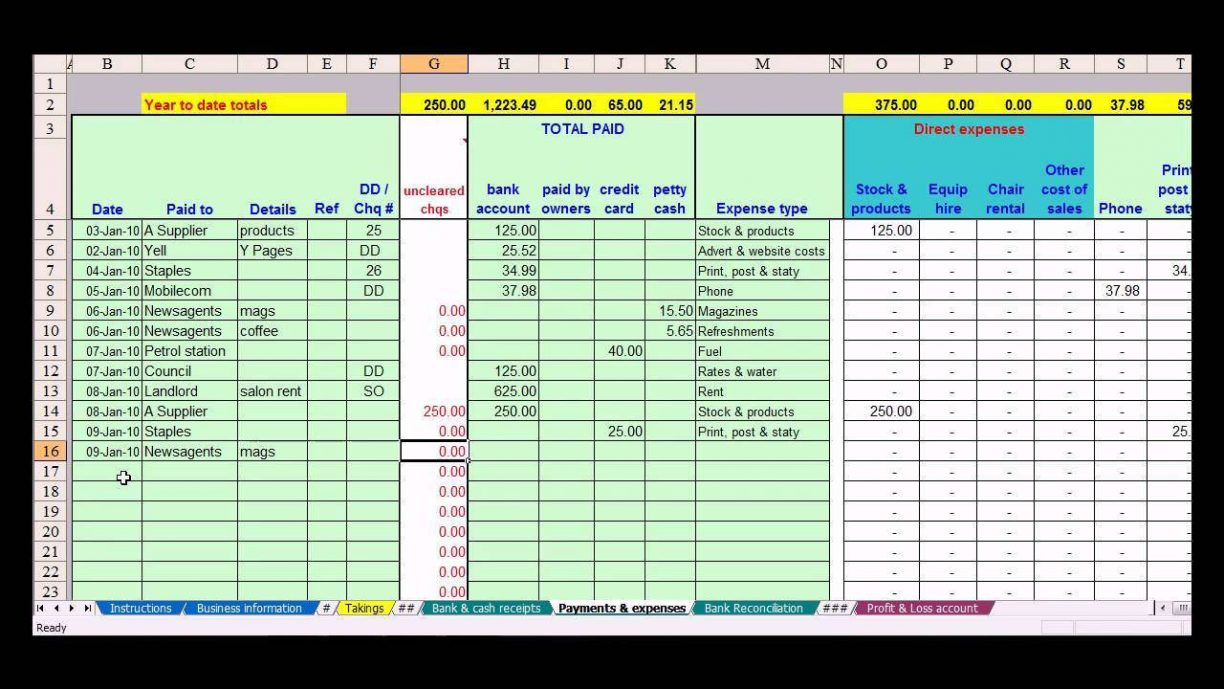

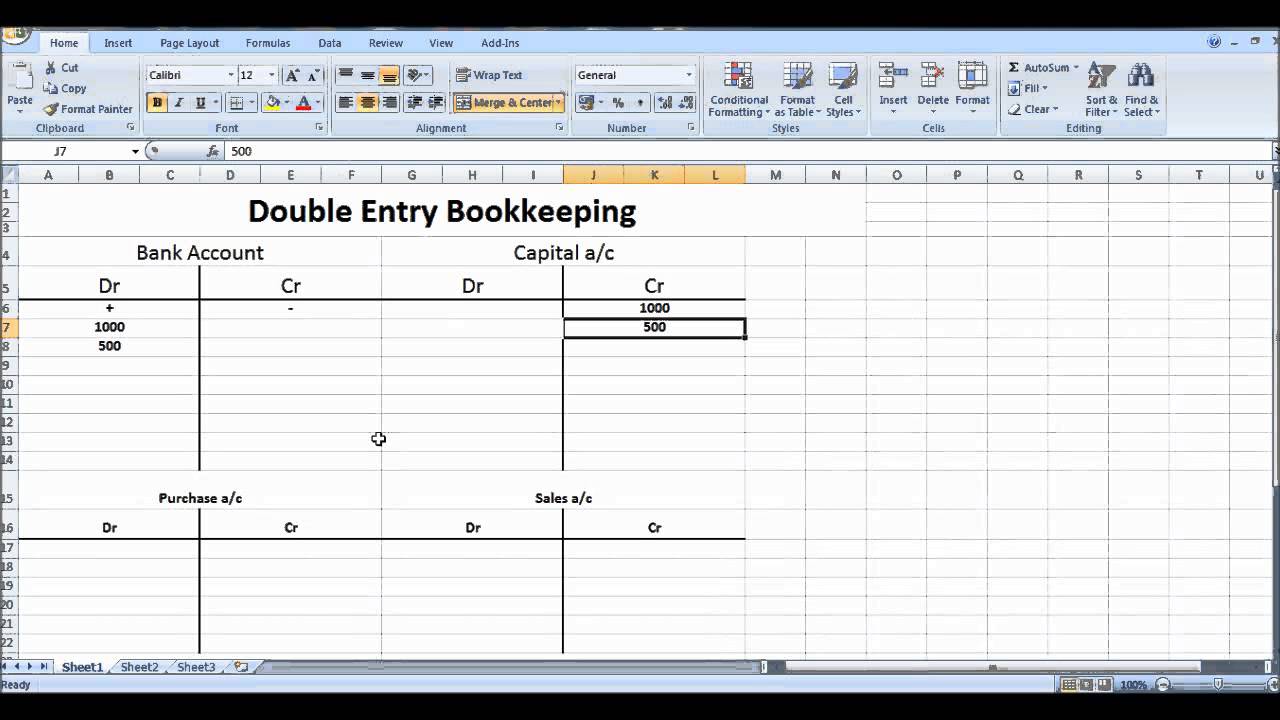

The double-entry approach, in other words, was a response to merchants, bankers, and investors, who found simple cash basis accounting inadequate. These include activities that complex businesses must track and manage, but which are invisible to simpler accounting systems. Such activities brought new kinds of business transactions. Merchants began selling "on credit," forming partnerships and companies, obtaining funding from private banks, and covering business investments with insurance. This period saw, for instance, rising levels of international shipping and commerce. This period saw new activity and new complexities in business, commerce, and banking that were unknown in the several centuries earlier, the "dark ages." Only Double-Entry Systems Meet All Business NeedsĮarly forms of double-entry accounting in Europe and Asia date from the late medieval period (1100-1450), as early as the 12th Century. Luca de Pacioli (1445-1517), a Franciscan friar, published the first systematic account of double-entry accounting. The Chart of Accounts as the organizing basis of a double-entry accounting system.Reasons that most firms choose double-entry accounting.

DOUBL ENTRY BOOKKEEPING EXAMPLES TRIAL

For more on this form of error-checking, see Trial Balance. That is, at all times:Ī mismatch in these two totals signals that the accounts have a bookkeeping or accounting error. When accountants and bookkeepers apply double-entry methods properly, the sum of all debit entries in the account ledgers for the accounting period must equal the sum of all credit entries. Built-In Error Checkingįirstly, the double-entry system builds-in a form of error-checking. The practice of using two account entries for every transaction in this way serves two purposes: 1. And, with a single-entry system alone, large firms cannot accurately track their assets, liabilities, equities, revenues, and expenses. They choose double-entry accounting because it is nearly impossible for them to meet government and regulatory requirements for reporting and record-keeping using a single-entry system. By contrast, just about anyone who can arrange numbers in a table and add and subtract, can set up and use a single-entry system.Īll public companies and almost all large firms nevertheless choose the double-entry approach. The user must, for instance, have a solid grasp of concepts such as debit, credit, Chart of accounts, and the two Accounting equations. Using a double-entry system requires at least some level of formal training in accounting. The majority of business firms worldwide rely on double-entry systems, even though they are more complex and more difficult to use than the more straightforward alternative, single-entry systems. Most Firms Choose the Double-Entry Approach Every financial event brings two transactions, a debit in one account and an equal, offsetting credit in another account. Debits on the left, Credits on the right-the hallmark of double-entry accounting.

0 kommentar(er)

0 kommentar(er)